If you are reading this, you must be in the early stages of buying a house. Congrats! What an exciting time. While exciting, it can certainly feel like an intimidating and overwhelming process. Money Compare is here as a useful tool to navigate you through the sometimes treacherous waters of the home buying process.

We have put together our 10 best tips to help get you started in your house buying journey.

1. Determine your goals and budget

Figure out your goals as a homeowner. Do you want to use the property for long-term investment? Or do you want to settle down into your very own place? Once you know what you want to do, you can then assess your financial situation and set up a budget. Different property goals can come with different criteria. For example, if you are seeking an investment property, you might need to look for a property that would suit a wide range of renters or buyers. But if you are looking for your first family home, you need to consider your unique family needs and interests.

2. Reduce your Bills by Comparing

Take advantage of NZ Compare’s array of powerful tools. Broadband Compare, Mobile Compare, and Power Compare help you compare providers and plans available to you so that you can make the most informed choice about your utilities and find a better deal. By finding a better deal, with NZ Compare’s comparison websites, you will save money month-to-month. Put the funds you ultimately save towards your deposit! You could save over $300 a year just by switching providers. Don’t pay lazy loyalty tax - compare, switch and save so you can build a bigger deposit for that house.

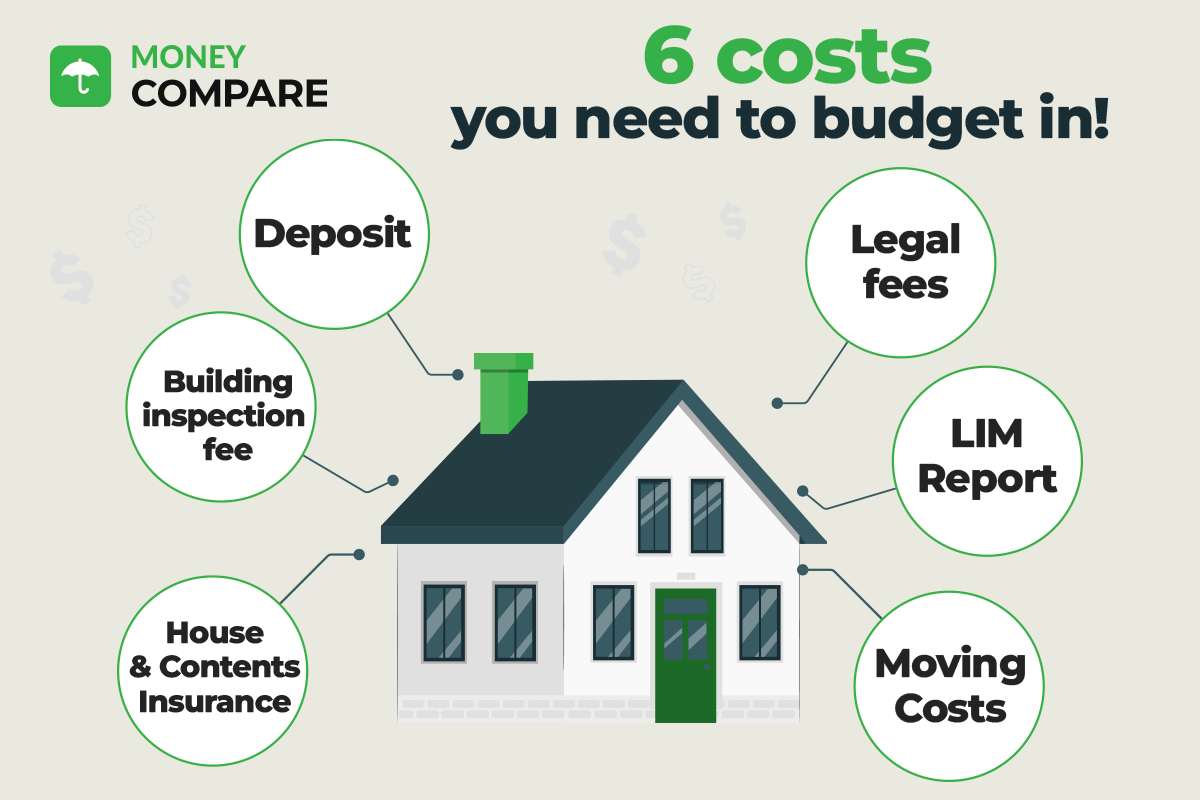

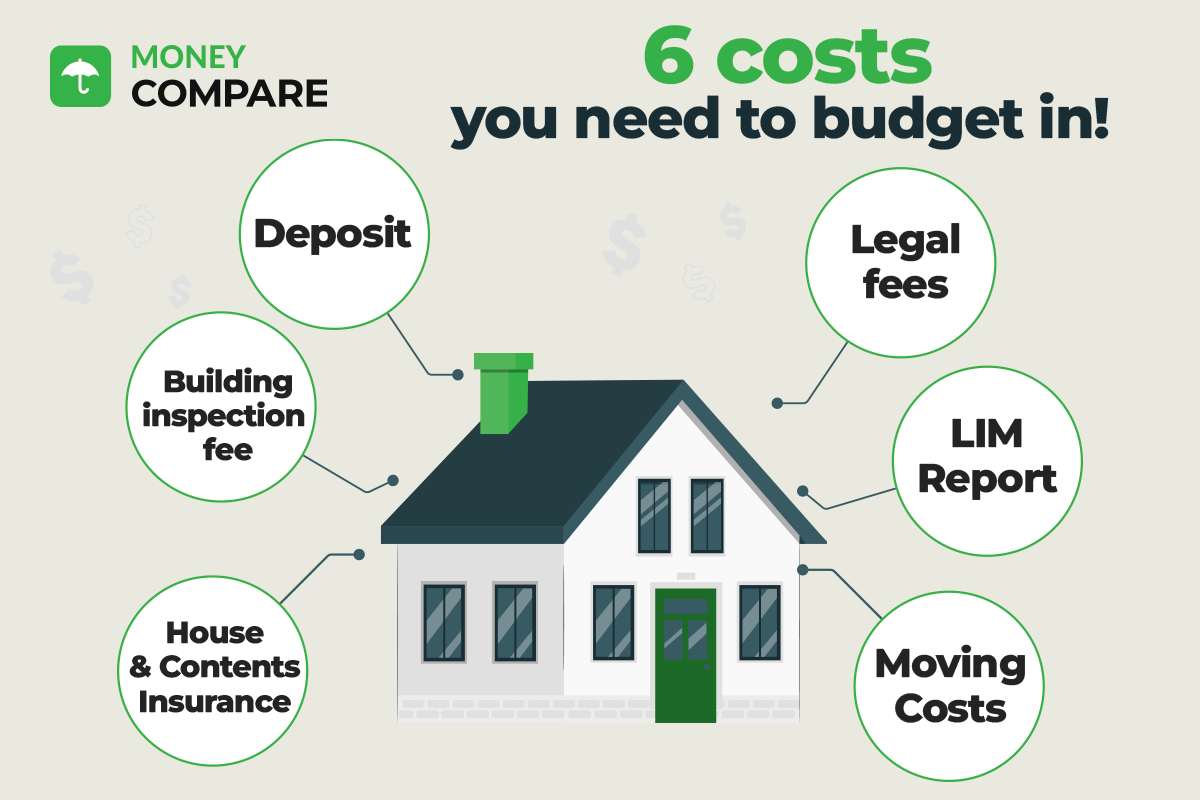

3. Start Saving for a Deposit

Saving up a deposit may seem overwhelming. But you’ve got this. Explore the different ways you could save money, such as creating a budget for your day-to-day expenses. What areas of your life could you cut your spending? Do you have subscriptions that you no longer need? Or can you reduce your takeaway night from weekly to monthly? The small costs add up quickly. For instance, if you have a coffee from your local 3-4 times a week, that could be a minimum savings of $936 per year. Button back on your small spending habits, such as reducing your coffee out to once per week. Put that together with other tiny costs being cut or reduced and you’ll soon have a few thousand that you didn’t before. Don’t forget that you can also use your Kiwisaver.

Learn About Investing Extra Funds into Kiwisaver

4. Figure out how much you Can Borrow

Before you hit up all the open homes, make sure you know how much you will be able to borrow. You don’t want to fall in love with something you can’t buy! Your bank or mortgage broker will be able to help you determine exactly how much this will be. Once you know, see if they can offer you a pre-approval. This is when a bank or non-bank lender agrees to lend you a determined amount of money. The amount you can borrow will depend on a couple of things including:

- The value of the home you would like to purchase

- How much of your deposit you have saved

- Your income

- How much your repayments can be after you’re other bills

5. Engage in a Qualified Mortgage Broker

Mortgage brokers are a valuable member in your home buying process. These professionals can provide you with personalised and tailored advice to your unique needs. They also have a vast array of potential lenders at their fingertips, so they can connect with you more options and opportunities. Mortgage brokers can even help with paperwork and negotiations.

Use Money Compare to research different brokers and find a reputable and experienced mortgage broker. Just don’t forget to double check their qualifications and seek recommendations and advice from an advisor. From the first conversation to the loan application and settlement, a mortgage broker will help streamline your entire home buying process.

6. Use a Mortgage Calculator

Money Compare has a plethora of user-friendly tools to help you determine how much you can borrow and estimate your potential mortgage repayments. This can help you with the planning and prepping process so that you have all the information on hand.

7. Compare Home Loan Providers

Money Compare is another powerful comparison website from NZ Compare. You can compare different mortgage rates and products from banks and non-bank lenders so that you can make the most informed decision around which home loan provider you ultimately choose.

8. Do your Homework

Figure out the prices of other homes in the area of search. Invest in a valuation report, which is designed to value the property with the purpose of making an offer. Make sure you ask the agent for statistics about other sales of similar properties in the area.

9. Have your Paperwork Ready

Gather everything together. Make sure you understand what funds you might be using and where they are coming from, such as your savings and Kiwisaver. Figure out who has to action which task between you, your lawyer, your bank, your Kiwisaver provider and your mortgage broker. If you know the plan, and have everything ready to go, you won’t be caught off guard when the right house lands.

10. Check the Condition of the Property

No one wants to ruin the excitement of purchasing a property by realising that the home is poor quality! It is worth investing in a property inspection report to avoid buying a home with issues. Make sure the inspection report will cover the bases such as moisture, leaky home, thorough inspections, electrical checks, plumbing checks and any repair estimates if any maintenance will need to occur to bring the property up to standard. Make sure you get a Land Information Memorandum (LIM).

Need Help? Our experts offer FREE advice

Here at Money Compare we have experts on hand to help with any home loan or mortgage query - simply request a free call back by clicking the button below and a fully qualified mortgage adviser will be in touch.