Customer: Sarah

Type of loan: Refinancing

Loan: $1,087,303.50

Deposit: Not required for refinance loan

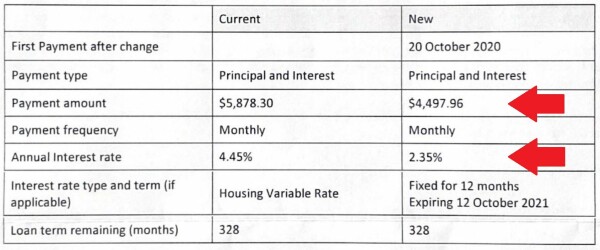

Saving: $1,380.34 per month

Sarah was unhappy with her home loan as she had read about interest rates for mortgages falling but had not seen the benefit in her own pocket.

Sarah wasn’t sure where to start in order to see if there was a more suitable product for her needs and she didn’t want to call her bank direct as she didn’t want to be ‘sold to’.

Sarah visited Money Compare to find out if refinancing her home loan would benefit her in terms of reduced interest rate, lower repayments and a more suitable home loan product. Sarah found that she was able to get both a reduction in interest rates and a better product.

When talking to one of the Money Compare Mortgage Broker Partners Sarah found that she was able to answer all of her questions and the broker recommended a few different products to suit her needs. Her current home loan product was a variable product and with the change in interest rates and uncertainty around the economy with an election and COVID looming, it was not working for Sarah.

Sarah found a specialist mortgage broker through Money Compare and this independent expert walked her through every step of the process around refinancing, and there was no fee for the service. The broker recommended a new product and once Sarah confirmed she wanted to go ahead they handled all the paperwork and processing.

By refinancing through Money Compare, Sarah's interest rate was reduced significantly from 4.45% APR to 2.35% APR, saving her over $1,380 a month. The process of working with the Money Compare recommended broker was simple, easy and free. If you are considering refinancing or unsure if you could make some savings use our easy online form. Just answer a few quick questions to help us understand which mortgage broker best suits your needs. Simply complete our short form and one of our experts will reach out within 24 hours to help you through the entire home purchase or refinance process.